The Con/Dem coalition has accrued more debt than all governments since 1900. The current government bears responsiblity for £1.2 trillion of the nearly 1.8 trillion-pound UK public debt, compared to £472 billion they inherited. The figures look even worse when you adjust for inflation. When you do that, the Coalition’s share jumps to over three quarters of the total debt.

But the Con/Dems do not meet the public needs, they simply serve the wishes of a powerful, wealthy elite. the Tories have bled the public dry. So, what have they done with the money? Because the public have seen only austerity cuts. And the most vulnerable bear the brunt of the cuts.

Oxfam’s director of campaigns and policy, Ben Phillips, said:“Britain is becoming a deeply divided nation, with a wealthy elite who are seeing their incomes spiral up, while millions of families are struggling to make ends meet.” It’s deeply worrying that these extreme levels of wealth inequality exist in Britain today, where just a handful of people have more money than millions struggling to survive on the breadline.”

Diseases associated with malnutrition, which were very common in the Victorian era in the UK, became rare with the advent of our welfare state and universal healthcare, but are they are now are making a reappearance.

NHS statistics indicate that the number of cases of gout and scarlet fever have almost doubled within five years, with a rise in other illnesses such as scurvy, cholera, whooping cough and general malnutrition. People are more susceptible to infectious illness if they are under-nourished.

In 2013/14, more than 86,000 hospital admissions involved patients who were diagnosed with gout – an increase of 78 per cent in five years, and of 16 per cent on the year before. Causes of gout include a lack of vitamin C in the diet of people who are susceptible, drinking alcohol (beer and spirits in particular) and a lack of a balanced diet generally.

The figures from the Health and Social Care Information Centre (HSCIC) show a 71 per cent increase in hospital admissions among patients suffering from malnutrition – from 3,900 admissions in 2009-10 to 6,690 admissions in 2013-14.

Cases of scarlet fever admitted to hospital doubled, from 403 to 845, while the number of hospital patients found to be suffering from scurvy also rose, with 72 cases in 2009/10 rising to 94 cases last year.

The figures also show a steep rise in cases diagnosed with cholera, a water-borne disease which was extremely prevalent in the 19th century, causing nearly 40,000 deaths. While total numbers remain low, the 22 cases last year compare with just 4 in 2009/10, the statistics show.

Dr Theresa Lamagni, Public Health England’s head of streptococcal infection surveillance, said the total number of notifications of scarlet fever this year has already reached 12,580 cases – the highest since 1970.

Cases of measles in hospital rose, from 160 to 205 cases, with a small rise in admissions for whooping cough, from 285 to 289 cases over the five years examined.

The figures on malnutrition follow a series of scandals of care of the elderly, with doctors, remarkably, forced to prescribe patients with drinking water or put them on drips to make sure they do not become severely dehydrated.

Charities have warned that too many patients are being found to be malnourished after being admitted to hospitals from care homes, as well as from their own homes.

This shouldn’t be happening in 21st century Britain and the Government’s response is hopelessly complacent. People are living under greater pressure and struggling with the cost of living. Hundreds of thousands are forced to turn to food banks and sadly it’s unsurprising people are eating less, and eating less healthily too. David Cameron needs to listen to what the experts are saying and tackle the cost of living crisis that is driving people into food poverty. Cases of malnutrition have been steadily increasing since the 2010 general election:

*In 2009/10 there were 3,899, hospital admissions

*In 2010/11 there were 4,660, hospital admissions

*In 2011/12 there were 5,396, hospital admissions

*In 2012/13 there were 5,594, hospital admissions

*In 2013/14 there were 6686, hospital admissions

There has been a rise of 71 per cent from 3,899 in the year up to April 2010.

Chris Mould, chief executive of the Trussell Trust which runs a nationwide network of food banks, said:

“This shows increases in diseases related to poverty and that’s alarming. Our food banks see tens of thousands of people who have been going hungry, missing meals and cutting back on the quality of the food they buy. We know quite a large proportion of the population are struggling to get nutritious food on the table. And at the extreme end of that you get people who are malnourished. We don’t believe anyone should have to go hungry in the UK”. The scale of the increases we’re seeing must be further investigated to find out why this is happening.”

Scurvy, a disease associated with pirates stuck at sea for long periods – has increased by 31 per cent in England since 2010. This is caused by a lack of vitamin C and is usually due to an inadequate diet without enough fresh fruit and vegetables.

https://www.youtube.com/watch?v=t1cUVg8n-uw

https://www.youtube.com/watch?v=t1cUVg8n-uw

Figures from January this year from the NHS indicate that there were 833 hospital admissions for children suffering from Rickets – a condition which is caused by a lack of Vitamin D, from 2012-13. Ten years ago, the figure was just 190.

The disease, which causes softening of the bones and permanent deformities, was common in 19th century Britain but was almost eradicated by improvements in nutrition.

The body produces vitamin D when it is exposed to the sun, but it’s clear that adequate diet plays an important role, too, since the decline of Rickets happened at a time when we saw an improvement in the diets of the nation as a whole.

It is thought that malnutrition is the main cause, children are most at risk if their diet doesn’t include sufficient levels of vitamin D. Low incomes, unemployment and benefit delays have combined to trigger increased demand for food banks among the UK’s poorest families, according to a report commissioned by the government and released earlier this year.

The report directly contradicts the claim from a government minister that the rise in the use of food banks is linked to the fact that there are now more of them. It says people turn to charity food as a last resort following a crisis such as the loss of a job, or problems accessing social security benefits, or through benefit sanctions.

The review emerged as the government comes under pressure from church leaders and charities to address increasing prevalence of food poverty caused by welfare cuts. The End Hunger Fast campaign called for a national day of fasting on 4 April to highlight the issue.

The report was written by food policy experts from the University of Warwick, and it was passed to ministers in June 2013 but had remained undisclosed until February 2014, creating reasonable speculation that the government suppressed its findings.

Examining the effect of welfare changes on food bank use was not a specific part of its remit, and the report is understood to have undergone a number of revisions since early summer, ordered by the Department for Food and Agriculture and the Department for Work and Pensions (DWP).

The researchers found that a combination of rising food prices, ever-shrinking incomes, low pay, increasing personal debt, and benefit payment problems meant an increasing number of families could not afford to buy sufficient food.

In a letter to the British Medical Journal, a group of doctors and senior academics from the Medical Research Council and two leading universities said that the effect of Government policies on vulnerable people’s ability to afford food needed to be “urgently” monitored.

The group of academics and professionals said that the surge in the number of people requiring emergency food aid, a decrease in the amount of calories consumed by British families, and a doubling of the number of malnutrition cases seen at English hospitals represent “all the signs of a public health emergency that could go unrecognised until it is too late to take preventative action”.

The health specialists also said: “Access to an adequate food supply is the most basic of human needs and rights”.

The authors of the letter, who include Dr David Taylor-Robinson and Professor Margaret Whitehead of Liverpool University’s Department of Public Health, say that they have serious concerns that malnutrition can have a long-lasting impact on health, particularly among children.

Tory ministers have repeatedly insisted that there is no “robust link” between the welfare reforms and rising food bank use, whilst welfare minister Lord Freud claimed the rise in food bank use was because there were more food banks and because the food was free.

It ought to be noted, not least by the government, that people may only access food banks when they are referred by a professional agency, such as social services, the DWP or a Doctor. In particular, vouchers for emergency food parcels tend to be given by benefits officials.

In all but exceptional cases, Trussell Trust food banks will only issue a food parcel to someone with a voucher from an accredited agency. Claimants are limited to emergency aid on three occasions only. This indicates that need, rather than availability, is the key reason for the increased use of food banks since 2010.

Together with the pressure created by rising prices and falling wages, there has been a marked increase in demand for emergency food aid since the welfare reforms came into effect. And this is affecting both people in and out of work.

More than half of people who have visited a food bank since April were referred because of social security problems.

The Government claimed the rapid increase in malnutrition cases “could be partly due to better diagnosis”.

I don’t imagine that it’s likely that Doctors have suddenly become better at diagnosis since 2010.

I do, however, think there is much scope for improvement in the capacity of Tory ministers for understanding correlation, basic cause and effect and simple connections.

However, Tory skills in mendacity, creating diversions and ad hominem are second to none.

Tory, Labour and Liberal Democrat manifesto’s all broadcast messages of continuing austerity in the next parliament in the years 2015-2020 . Indeed the Tory’s are set to more than double hardship levels for the public. Labour and Liberal Democrats are intent on pursuing similar public punishing measures. These brutality of these agendas will take the UK back to the 1930’s. What a legacy we are passing on to our children.

Paul Robin Krugman is an American economist, Professor of Economics and International Affairs at the Woodrow Wilson School of Public and International Affairs at Princeton University, Centenary Professor and Nobel Memorial Prize Winner in Economic Sciences

At the time of the 2010 General Election Paul Klugman urged British voters not to support the opposition Conservative party in the 2010 General Election, arguing that Party Leader David Cameron “has had little to offer other than to raise the red flag of fiscal panic.”

The Austerity Delusion – Written in 2015 – Paul Klugman Urges the UK to turn away from austerity providing good reasons – All but Nicola Sturgeon are continuing to bury their heads in the sand determined to continue and increase the misery of the UK public

n May 2010, as Britain headed into its last general election, elites all across the western world were gripped by austerity fever, a strange malady that combined extravagant fear with blithe optimism. Every country running significant budget deficits – as nearly all were in the aftermath of the financial crisis – was deemed at imminent risk of becoming another Greece unless it immediately began cutting spending and raising taxes. Concerns that imposing such austerity in already depressed economies would deepen their depression and delay recovery were airily dismissed; fiscal probity, we were assured, would inspire business-boosting confidence, and all would be well.

n May 2010, as Britain headed into its last general election, elites all across the western world were gripped by austerity fever, a strange malady that combined extravagant fear with blithe optimism. Every country running significant budget deficits – as nearly all were in the aftermath of the financial crisis – was deemed at imminent risk of becoming another Greece unless it immediately began cutting spending and raising taxes. Concerns that imposing such austerity in already depressed economies would deepen their depression and delay recovery were airily dismissed; fiscal probity, we were assured, would inspire business-boosting confidence, and all would be well.

People holding these beliefs came to be widely known in economic circles as ” Austerians”– a term coined by the economist Rob Parenteau – and for a while the austerian ideology swept all before it.

But that was five years ago, and the fever has long since broken. Greece is now seen as it should have been seen from the beginning – as a unique case, with few lessons for the rest of us. It is impossible for countries such as the US and the UK, which borrow in their own currencies, to experience Greek-style crises, because they cannot run out of money – they can always print more. Even within the eurozone, borrowing costs plunged once the European Central Bank began to do its job and protect its clients against self-fulfilling panics by standing ready to buy government bonds if necessary. As I write this, Italy and Spain have no trouble raising cash – they can borrow at the lowest rates in their history, indeed considerably below those in Britain – and even Portugal’s interest rates are within a whisker of those paid by HM Treasury.

All of the economic research that allegedly supported the austerity push has been discredited

On the other side of the ledger, the benefits of improved confidence failed to make their promised appearance. Since the global turn to austerity in 2010, every country that introduced significant austerity has seen its economy suffer, with the depth of the suffering closely related to the harshness of the austerity. In late 2012, the IMF’s chief economist, Olivier Blanchard, went so far as to issue what amounted to a “mea culpa” although his organisation never bought into the notion that austerity would actually boost economic growth, the IMF now believes that it massively understated the damage that spending cuts inflict on a weak economy.

Meanwhile, all of the economic research that allegedly supported the austerity push has been discredited. Widely touted statistical results were, it turned out, based on highly dubious assumptions and procedures – plus a few outright mistakes – and evaporated under closer scrutiny.

It is rare, in the history of economic thought, for debates to get resolved this decisively. The austerian ideology that dominated elite discourse five years ago has collapsed, to the point where hardly anyone still believes it. Hardly anyone, that is, except the coalition that still rules Britain – and most of the British media.

I don’t know how many Britons realise the extent to which their economic debate has diverged from the rest of the western world – the extent to which the UK seems stuck on obsessions that have been mainly laughed out of the discourse elsewhere.

George Osborne and David Cameron boast that their policies saved Britain from a Greek-style crisis of soaring interest rates, apparently oblivious to the fact that interest rates are at historic lows all across the western world.

The press seizes on Ed Miliband’s failure to mention the budget deficit in a speech as a huge gaffe, a supposed revelation of irresponsibility; meanwhile, Hillary Clinton is talking, seriously, not about budget deficits but about the “fun deficit” facing America’s children.

Is there some good reason why deficit obsession should still rule in Britain, even as it fades away everywhere else? No. This country is not different. The economics of austerity are the same – and the intellectual case as bankrupt – in Britain as everywhere else.

http://www.theguardian.com/business/ng-interactive/2015/apr/29/the-austerity-delusion

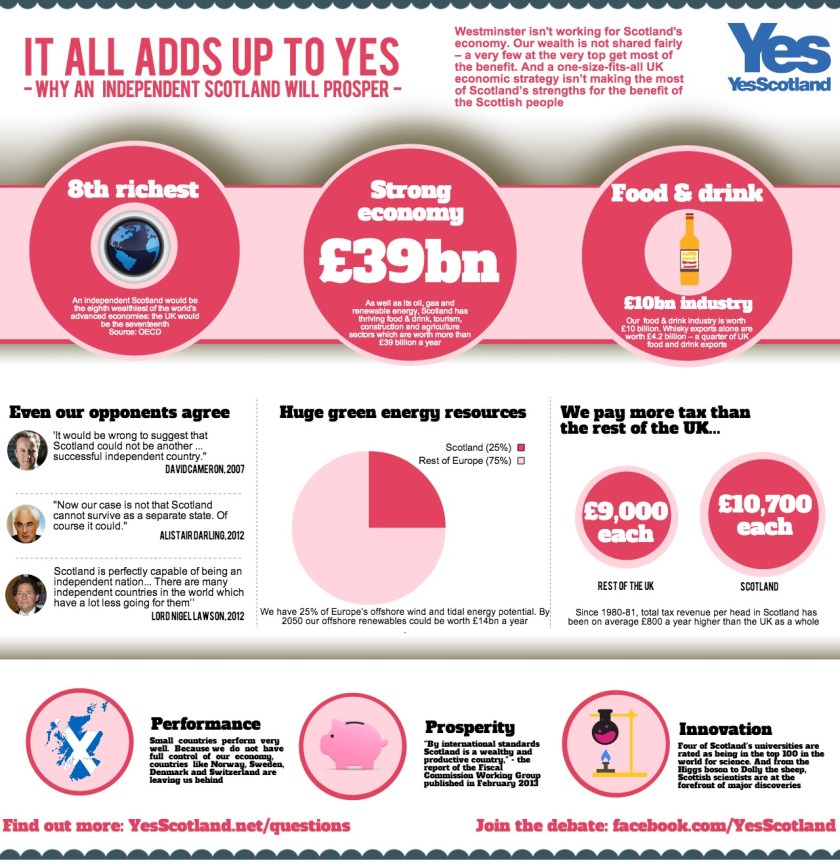

The SNP manifesto provides an agenda for change abandoning the failed austerity programme of the other parties in favour of growth expanding the economy, creating jobs, security, and wages. This is a proven methodolgy which will do much to lessen the hardship of the UK public since it will bring about a transfer of money away from the richest 1% back to the public purse for use in expansionist programmes.