1986: The British American Project – The USA Groomed Gordon Brown and the Labour Party for office in the 1980s

The US, International Visitor Program is a subtle exercise that trades heavily on America’s considerable cultural and social capital, in other words its soft power. But the altruistic aspect of providing the trip is always balanced with the intention of some kind of return. An invitation offered at the start of a young, obviously talented politician’s career can pay off later if, as expected, that politician rises through the ranks in the following years.

A US funded trip has the potential; thanks to the extra information sources or contacts it can provide, to be career enhancing, particularly for those in the media or academics but also for MPs. It is not a case of undue influence but of pragmatically attempting to establish favourable, constructive relations early on with someone expected to achieve greater influence in the future. The element of chance that it will succeed in the long term is of course large. In 1984 the International Visitor Program showed the first signs of this approach, with an invitation, (accepted) to Gordon Brown.

1998: Ah !!! The Private Finance Initiative, (PFI).

Lest we forget. The PFI presented as one of the greatest financial cock-ups in modern times, recklessly committed to by the Labour government, smitten by the spell of Thatcher’s acolytes Blair & Brown.

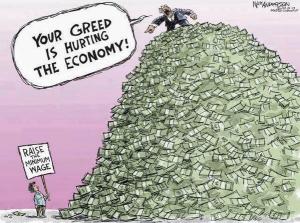

The sell-off, of, in excess of 1000 UK taxpayer owned buildings to private enterprise was a disgrace then and is even more so now. The UK will effectively be handing over vast amounts of rent money, (leasing back, formally owned depreciating assets) from a foreign owned conglomerate, (Mapeley Steps) almost without limit of time. What a disaster.

Adding insult to injury the company, having bought the properties at a knock down price then immediately transferred ownership title and all other aspects of the contract to a Caribbean tax haven so that all revenue gathered from the UK government would be free of any form of UK tax liability.

Embarrassing indeed, but there’s more. The property sell off, included the entire HM Revenue and Tax Office estates UK wide, who, at the time of the sale were officially committed to the closure of tax haven loopholes. You couldn’t make it up.!!!!! Scotland needs to be rid of these extortionately financially draining PFI schemes. http://www.publications.parliament.uk/pa/cm200405/cmselect/cmpubacc/553/553.pdf

THREE FULL YEARS BEFORE THE (TOTALLY UNEXPECTED) FINANCIAL DISASTER HIT THE UK

2004: Warnings Ignored – Warnings Ignored – Warnings Ignored – Warnings Ignored – Warnings Ignored

Lyndon H Larouche jr. ranks highly among the world’s most influential international political figures. His exceptional qualifications as a long-range economic forecaster, was confirmed when, in 2004 he forewarned in the “Executive Intelligence Review” of the erupting, global systemic crisis of the world’s economy.

2004: Warning of Unsustainable House Prices

House prices in Southern England were at the outrageous level of 7.5 times local earnings. Nationwide, the multiple was 5.6. Since 2001, house prices had risen by one-third in Greater London, but almost two-thirds in the rest of the UK. Halifax Bank, The UK’s biggest mortgage lender, reported that the average UK property now cost nearly £158,000.

UK householders were borrowing heavily on the bubble. In April, they took out a record £6.4 billion against the value of their houses, household debt was at a record 120% of disposal income, up from 100% during the pre-crash 1980s. as a direct result of ever increasing net mortgage borrowing which year on year was up:

* 27% over April 2003

* 60% over April 2002

* 131% over April 2001!

In France, by comparison, household debt was 58.7% of disposable income. Bets were being taken, which would burst first, the UK debt bubble, or Tony Blair’s political career.

2004: Economy Overheating – Brown Dithering

Then, there was the economy. The Bank of England chose 10 June 2004 to announce it was raising interest rates by a quarter-point for the second time in two months.

This was even a greater blow for Blair. Bank Governor Mervyn King followed up, four days later, with a blunt speech warning price inflation was now over 20% a year in Britain.

With credit card and other debt added on to mortgage obligations, British households were £1 trillion ($1.835 trillion) in debt — a bubble just as bad, per capita, as that in America.

One trillion pounds debt equals Britain’s annual output, the Financial Times noted sourly on 2 June 2004.

2004: Britain’s Housing Bubble Surfaces.

Already, the Bank of England had carried out four 0.25% to bring its base rate up to 4.5%, and there was widespread discussion that the rate would need to be raised to 5% before the year end.

Bank Governor Mervyn King’s June 14 statement that British home prices were not sustainable shook up the financial markets, and in a limited way, acknowledged the problem.

But while King and Greenspan made different public statements, both they and their respective central banks indicated that they hoped for a miraculous soft landing for their twin housing bubbles.

That is a fantasy wish: such highly-leveraged, immense housing would suffer a hard landing.

Synarchists Cheney and Blair would need to be prudent and prepare to experience their very brief last days in office.

Click to access eirv31n25-20040625_068-election_fiasco_kicks_blair_new.pdf

2004: Local and European Election Fiasco – Blair Takes A Kicking

British Prime Minister Tony Blair suffered his worst humiliation, in the June 2004 local elections and European Parliament contests across England and Wales, since he was elected in May 1997.

The result of Blair’s Labour Party’s miserable showing in both, is that the Prime Minister is now, at best, a lame duck, In the local council elections, ripe to be removed from power at some early date in the coming months.

In London on June 15, Blair showed the strain in his monthly press conference; he was rambling, losing track of his thoughts in mid-sentence, and issuing contradictory political assertions.

British press the next day noted that the best indication that Blair was losing it, was that he broke down amidst the subject he loves best: praising himself and the great domestic “successes” of his New Labour regime. He resigned not long after.

2006: Gordon Brown, “The Leaker” sets the standard for Jim Murphy and fellow Labour politicians to follow

During his long years in opposition Brown became a regular conduit for publicising confidential documents leaked to him by civil servants and he was admired for the way he could put them to good use when attacking the Conservatives. Once Labour were in power, he demonstrated an equally deft touch when making use of the journalists he could trust.

The press build-up his Budgets and financial statements was always carefully manipulated to prepare the ground for any changes which he intended to make and Brown continued as Prime Minister to be Labour’s leading exponent of institutionalised leaking.

At the time he was interviewed by the BBC’s Frank Bough in July 1985 he just couldn’t avoid gloating and smirking about the leaks he had orchestrated, received and passed on through his network of minions who were always eager to do his murky deeds.

Many people will have cause to have hatred in their hearts for him. He has departed the scene as a politician, but he leaves a foul stench that will linger for years to come. https://www.youtube.com/watch?v=QIrweIqqsOc

2007-2008: Financial Disaster

In the period 2004-2008 Brown then Alistair Darling ignored much repeated advice and public warnings issued by Lyndon H Laroche JR, many other eminent economists and Mervyn King, Governor of the Bank of England of the rapidly overheating British economy.

The financial “blow out” that hit the world financial markets in 2007 was brought about by defaulting mortgage holders in the USA and the UK who had been contracting to significant additional debt against their properties through excessive loans creating an unsustainable housing bubble.

Brown and Darling, conspired to divert blame away from the Labour government and had the audacity to blame the Royal Bank of Scotland for the financial disaster that befell the UK when it was clear the mismanagement of the economy was entirely the fault of a Labour Party leadership who had been warned in 2004 of an impending financial wipeout.

At a time the UK should have been introducing measures taking the heat out of the economy Brown and Darling instead played fast and loose with the electorate pushing on with a wilful expansion of the financial market, approving bank mergers funded by borrowing, looking forward only to the next General Election.

March 24 2009; European Parliament, Strasbourg – British Prime Minister Gordon Brown Is Taken Apart By European MEP’s

An unelected Prime Minister, never elected to office who forced through the Westminster parliament ratification of the ill judged European treaty setting aside a clear Labour Party manifesto commitment allowing the British electorate the decision in a referendum. A really nasty man who will depart politics leaving a foul odour.

In office he sold large amounts of Britain’s gold reserves for a pittance, losing the country many billions and when this didn’t give up enough to fund the largesse of the Labour Party he raided the pension funds of Britain’s pensioners asset stripping, rendering them in danger of collapse.

In his unadulterated flannel of a speech to the European Parliament he exposed a nightmare vision of a Labour Party dominated future state. A loathsome man indeed!! https://www.youtube.com/watch?v=n1WlpzvgciY

Leave a comment