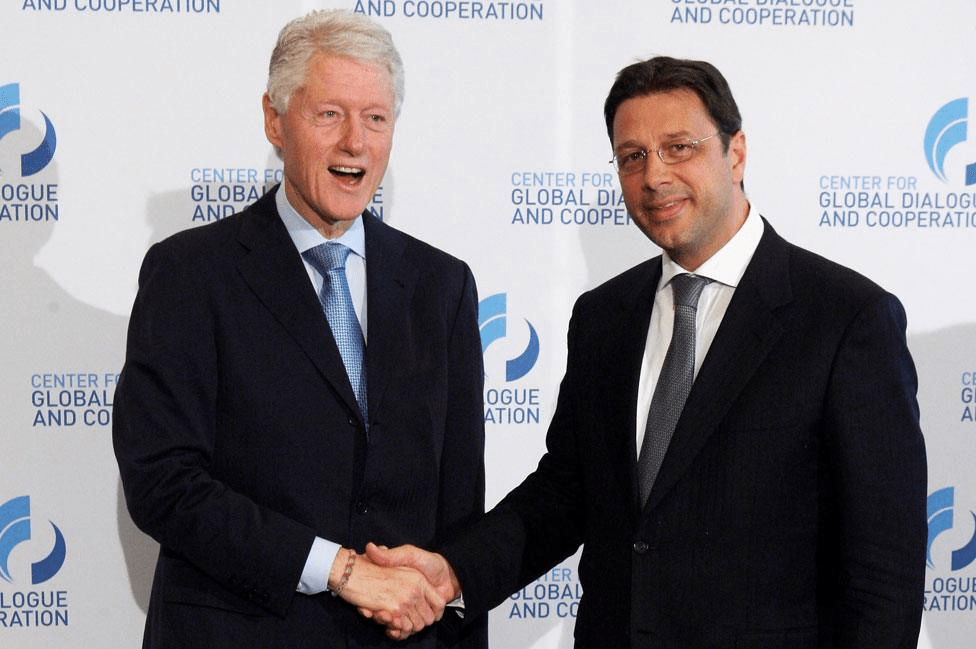

What do a Maltese academic, a Swiss lawyer, and a fugitive Kazakh oligarch have to do with each other? A lot, according to the Mueller investigation, which established that corruption is live and well in the world of financers and politicians.

On October 30, 2017, Special Counsel, Robert Mueller revealed that former Trump campaign adviser George Papadopoulos had admitted making false statements to FBI agents about contacts he had with Russian citizens while working for the Trump campaign in 2016.

What unravelled was a series of events so huge it covered international espionage, off-shore banking, dodgy real estate deals, mobsters, money laundering, poisoned dissidents, computer hacking, and the most shocking election in American history.

The character that allegedly provided the snake oil that fuelled the political mirage was Maltese, Professor Joseph Mifsud of the London Academy of Diplomacy whose circle of colleagues included financial fixers backed by oligarths operating out of Cyprus and other places.

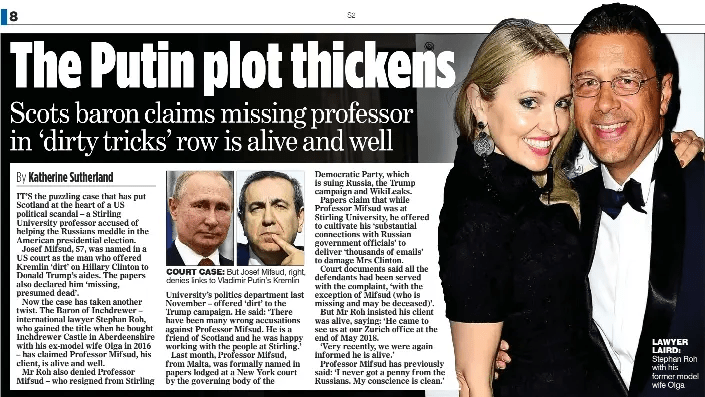

This article highlights one of his colleagues an influential mover and shaker – Dr Stephan Roh

2004: Dr Stephan Roh, established a law firm, RoH Attorneys at Law, with Offices in; Zurich, Zug, Berlin, London and Hong Kong. (www.rohlaw.com). The firm’s sales pitch proferred that clients would be assured of optimal solutions suited to their demands in law, banking legislation, financial markets and international trading.

2005: Roh purchased a small British nuclear firm called Severnvale Nuclear Services Ltd. Under its previous owners, the company’s turnover had been £42k a year. Within three years, annual turnover increased to over £24 million, despite having only two employees.

Roh later renamed the company Severnvale Nuclear Services Ltd based in Bristol. Links to the Clinton inspired Uranium1 scandal.

2006: Roh founded a number of Cyprus based companies whose investments were mainly in Russia, through an actively managed concentrated and hedged portfolio of different asset classes including, securities, real estate and venture capital.

P & C GLOBAL GOLD & NATURAL RESOURCES FUND LTD

FINDUSTRIA LTD

R & B RUSSIA INVESTMENT FUND LTD

FILTAR CO. LTD

ARAMITE HOLDINGSLTD

BRS FAMILY OFFICELTD

DISTANT HOLDINGS LTD

ALMAGEN LTD

FRIANTO TRADING LTD

R & B SELECTED STRATEGIES INVESTMENT FUND LTD

EAST STAR DIVERSITY FUND LTD (cover for the involvement of Russian Oligarch Gleb Fetisov. Financial backing from Centre Invest Capital Partners)

Why Cyprus? Freedom of movement afforded opportunities for Oligarths and other financially well off former eastern bloc countries to transfer their wealth to and take up partial residence in Cyprus where banking was not tightly regulated.

Residence in Cyprus was attractive since a capital investment in a property and 6 monthly residence annually or thr purchase and retention of Cypriot bonds to a value in excess of around £2 million allowed incomers to apply for and benefit from the dual nationality of European citizenship.

An example: A Russian, who purchased a substantial property, would be able to gain a euro passport and transfer his company to Cyprus where it would benefit from a tax free investment income for many years with the added benefit that all matters financial would be retained in Cyprus in compliance with his tax residency status. But did they really move to Cyprus? Not always. Who checked? Anyways; 2000 passports and inward investment of £5 Billion spelt success for the policy.

2006: Roh founded, International Legal Services (ILS) and the Energy Consulting Group (ECG) – both registered in Hong Kong. Mission statements said the companies provided international legal, financial and fiduciary support and energy services to the energy industry worldwide including crude oil, gas & gas products, refining, nuclear, petrochemicals and power generation industries. Its people included; Georgy Gomshiashvili, Thierry Pastor, (Moscow Office), Konstantin Danilov, Zhanna Rais, Daniel Schröder, Gert-Rainer Neumann and Alekseeva Kseniya

2009: Roh founded the R&B Investment Group (http://www.rbinvestgroup.com) a London based management and business consulting firm, located in the heart of Mayfair. The sales pitch said that it provided company management and advisory services to an international clientele through its subsiduary companies. Its funds were registered in Cyprus, within the European Union jurisdiction and were subject to European regulations and laws guaranteeing a high degree of investor protection.

Its companies included;

ABN AMRO, (Zurich) providers of portfolio management, custody, and fiduciary transaction services and investment advice. In addition, it provided securities transaction services for private and institutional customers and currency dealing.

Marmite Capital Ltd (Zurich) independent asset managers whose core competences included portfolio management and advisory investment.

R&B Financial Services Ltd, (Zurich) Provision of asset management services and on a trust basis, the acquisition, management and sale of participations in other companies of all kinds at home and abroad as well as related investments, corporate finance, borrowings, loans issued to related parties or to third parties. Services such as consulting and business support for the establishment and maintenance of business and trade relations and the exchange of business and finance for trade and investment in related fields.

The Russia Investment Fund. Financial analysis and advice through: Renaissance Capital, (Rencap) a premier Russian investment house based in Moscow and Cyprus. Co-Chief Executive Officer Ruslan Babaev. Rencap provided a full range of investment banking products and services, including equity and debt sales and trading, corporate advisory, capital raising, research, structured solutions and derivatives. Clients included corporations, governments, institutional investors and individuals.

2010: Roh’s links to Kazak Embezzler Ablyazof revealed, Read this article for briefing about his crimes:

2010: Investigators located an Ablyazov owned storage unit in London and searched it. They recovered 25 boxes of documents and hard drives that revealed the vast scope of Ablyazov’s offshore empire, including listings of hundreds of interconnected shell companies.

Roh was listed as a director with at least 25 companies mainly registered in offshore financial havens of the British Virgin Islands and the Marshall Islands.

The 25 firms were also linked to the Kazakh lawyer and human rights activist Bota Jardemalie, a former senior manager with Ablyazov’s bank who fled the country with him. Interviewed in Belgium where she was granted asylum in 2013 she said that Ablyaxov was a political ally but didn’t mention their business relationship.

2013: The High Court in London issued a receivership order on the 25 companies and added Roh’s law business in 2014. The Court has since added another 600+ companies to the receivership order, “on the basis that there is good reason to believe that they are all in Ablyazov’s ultimate beneficial ownership.”

Roh was never just a peripheral figure in many large schemes involving billions of dollars and hundreds of companies and the aforementioned 25 companies were not the only link between he and Ablyazov.

2016: the Organized Crime and Corruption Reporting Project (OCCRP) and the Balkan Investigative Reporting Network (BIRN) claimed that a decade earlier Ablyazov had used a series of offshore entities to invest in an entertainment complex and hotel in Belgrade, the capital city of Serbia, using his bank’s funds. What wasn’t reported was the involvement of Daniel Schroeder, a senior lawyer in Roh’s law firm. The project, valued at around $50 million was financed by an Ablyzov company, Glintmill Investments, of which Schroeder was a director controlling 70% of the company

2016: Roh’s association with Ablyazov included a Dubai-based British accountant named Eesh Aggarwal who was listed as a financial advisor loyal to Ablyazov. It was alleged that Aggarwal handled about half a billion dollars of Ablyazov’s money through his son-in-law, Ilyas Khrapunov.

2018: The High Court ordered Khrapunov to pay over $500 million in damages for conspiring with Ablyazov to breach the freezing order. The judgment found that starting in 2011 Khrapunov had hired Aggarwal to manage $500 million of Ablyazov’s assets.

2013: “Beron” an Aggarwal company agreed to transfer $2 million to a company controlled by Georgy Gomshiashvili, a senior lawyer at Roh’s firm. Gomshiashvili, who was born in Russia, was first introduced to Aggarwal by Peter Sztyk, who was married to Ablyazov’s close confidante Jardemalie. Roh said that neither he nor his law firm had been involved in any of Khrapunov’s US dealings and investments.

2012: Roh had become entangled with Ablyazov the business tycoon who was guilty of money laundering on a massive scale. Evidence showed that Roh companies and his legal and business partners were used to move assets and funds belonging to Ablyazov and his close associates. All at a time when legal proceedings against Ablyazov were ongoing and his assets were subject to multiple freezing orders in the US and UK.

2012: R&B Investment Group, was also linked to Ablyazov through business with FM, a Marshall Islands-registered entity. In a contempt judgement a British court said Ablyazov lied when he denied being the beneficial owner of shares in the company and it should have been subject to a freezing order. Documentation revealed a 2006 transfer of £20 million from FM to R&B Investment Group the sole shareholder of which was Roh.

2013: Roh formed “Inverhold”. In 2019 he renamed it “No Vichok Ltd” following the Salisbury incident in which an alleged Novichok nerve agent was used to poison Russian double agent Sergei Skripal and his daughter. The business of the company is not known.

2014: Roh purchased Rome based, Link Campus University. The Roh strategy for the university was to widen its base embracing internationalization, gaining a place for it on the stock market through the establishment of long term agreements with leading international universities and a major investment partner.

An agreement was signed with the Lomonosov University of Moscow, one of the most prestigious Russian universities aimed at developing scientific and educational cooperation and providing for the opening in Rome of the ” Centre for Science and Education Lomonosov.” It is expected that other partnerships will include UK and US Universities before the end of 2016.

Drake Global Ltd, a UK investment company registered in the British Virgin Islands Islands evaluated the new venture at 50 million euro and acquired 5%. a percentage sharing scheduled to increase to 49% before April 2017. Roh stated: “Rome will be the first step, but the intent is to open the Link Campus University other locations around the world, from Hong Kong.” (http://linkinternational.eu/)

2016: there were 25 international partnerships between Link Campus, in Rome and other universities.

Russian partnerships:

Lomonosov Moscow State University.

Kuban University of Physical Education, Sport & Tourism.

Kaliningrad State Technical University.

Sholokhov Moscow State University for Humanities.

Ural State University of Economics.

Baikal State University of Economics and Law.

Saint Petersburg State University of Services and Economics.

Other partnerships:

LSE Enterprise.

Princess Sumaya University of Technology (Amman, Jordan).

Nyenrode Businesss Universiteit (Holland).

University of Murcia & Cartagena (Spain).

London Academy of Diplomacy (UK).

University of Haifa (Israel).

Mediterranean University of Albania (Albania).

Beirut Arab University (Lebanon).

El Colegio Mayor de Nuestra Señora del Rosario (Colombia).

University of East Anglia (UK).

The Italian American Institute, Queens College (USA).

Koblenz- Landau University (Germania).

International Institute of Management IMI –Nova (Moldova).

Technická Univerzita v Kosiciach – Kosice (SK).

Universität Koblenz – Landau (DE).

Marii Curie-Sklodowskiej w Lublinie – UMCS – Lublin (PL).

St. Kliment Ohridski – Sofia (BG).

Universidade do Algarve – Faro (PT).

2014: Roh became a visiting lecturer at the London Academy of Diplomacy.

2016: Roh founded the London Centre for International Law And Diplomacy Ltd. Previously listed under the name of Global Global the company was re badged on 16 Feb 2016 and located in London, replacing the London Academy of Diplomacy, after it closed. Business purposes included; other education not elsewhere classified. Mifsud was appointed, Convenor and Director for International Strategic Development. Papadopoulos was appointed, Director for International Environment, Energy and Natural Resources Law. The company was renamed, “Checkpoint News Limited.” in 2019.

Roh and his Russian-born wife, Olga, have homes in Switzerland, Monaco, London and Hong Kong. And then there is a derelict castle in Scotland – buying it made Stephan and Olga the Baron and Baroness of Inchdrewer.

Information summarised from publications posted on-line by a number of sources including: Buzzfeed, Atlantic, Real Clear Investigations, Forensic News and other blogs.