Time For Scotland To Escape the Madness

The outcome of the next UK general election is already established. The Tories will be returned to power and Scots will be subjected to rule (for another 5 years) by a government it did not vote for. There is so much to be done to progress Brexit to the conclusion desired by the Tories and anything, anyone or any organisation that stands against their intent will be destroyed.Scotland’s final opportunity for independence needs to be grasped and a campaign put in motion before the spring of 2017.

In support of the foregoing I looked back at the banking scandal that brought the World to it’s knees and the many years of austerity forced upon Scots by Cameron, Osborne and the financially well off who were determined that the massive financial deficit would be recovered from the many, (who had done nothing wrong) rather than the financial gangsters that had created the problem.

A couple of high profile Bankers, (Bob Diamond and “Fred the Shred” Goodwin) were forced to retire, with the promise of huge personal pension schemes, coupled with obscene lump sum final settlements. But not one Banker faced court proceedings.

Instead the Banking system continued very much as before (as though nothing untoward had occurred) . Obscene Bonus schemes were retained and further extended so that Bankers would be assured austerity would not be applied to the financial services.

If not the bankers and the rich this left the burden of financial restraint with the Chancellor of the Exchequer, George Osborne to resolve. Which he did, borrowing many billions of pounds from nameless but very rich institutions, who had avoided the financial crash!!! Payback was charged to the UK electorate so that the many settled the debts of the rich. Unfair.

The remaining part of this report provides historical data proving that the financial excesses of the recent past were no accident and they will be repeated again and again by a financially corrupt electoral system that allows a bunch of spivs to exercise authority over Scots who deserve better governance.

.

30 Jun 2012: Cameron allies linked to City firms are under scrutiny over interest rate fixing

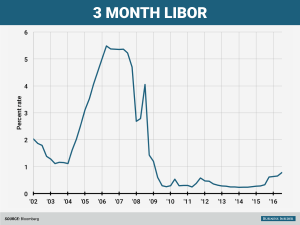

Senior Tories were dragged into the interest rate-fixing scandal as fresh evidence emerged that the banking industry denied there were any problems with “the integrity” of Libor five years ago.

It has been revealed that the Conservative deputy chairman, Michael Fallon, is a board member of a leading brokerage firm that dominates the rates market and which has been asked to co-operate with the Financial Services Authority’s investigation into malpractice across the City. Fallon is a close ally of David Cameron and a senior member of the Treasury select committee that will question the Barclays chief executive, Bob Diamond, this week, prompting demands from Labour that he should declare an interest.

The Prime Minister continues to resist calls from Ed Miliband for a Leveson-style inquiry into rate-fixing. The Government is to set up an “urgent independent review” into Libor (the London inter-bank lending rate), but Labour continued to press for a judge-led inquiry. The review will consider the future operation of the Libor rate and the possibility of introducing criminal sanctions, a Treasury source said.

Class-action lawsuits are being filed in the US by plaintiffs that held financial products that depended on Libor. Any lawsuits that arise are likely to dwarf the fines that Barclays has already paid, perhaps running into the tens of billions across the industry. The IoS can also reveal that the Bank of England was aware of concerns over Libor five years ago, and discussed it in at least two meetings with representatives of some of the City’s biggest financial institutions.

Fallon, the MP for Sevenoaks, has been a director of interdealer broker Tullett Prebon since 2006, standing down in 2010 when he ran unsuccessfully for chairman of the select committee, before being reappointed that year. Tullett Prebon is not under full investigation by the FSA into manipulation of Libor but has responded to “requests for information”. A City source close to the investigation said it was “extremely unlikely Tullett Prebon would not be investigated” at some point, and sources at the firm, asked if employees could have engaged in wrongdoing, said they could “never say never”. There is no suggestion of wrongdoing on the part of Fallon or the company. In a statement the firm said: “Tullett Prebon, like probably all firms in the City, has been responding to requests for information from the regulators. To date, we have had no cause to suspend or otherwise discipline any employee in connection with this inquiry.”

Labour said the Tory deputy chairman had “serious questions” to answer over his role at the firm, given his key role in Parliament’s inquiry into the rate-fixing scandal, which is thought to extend far beyond the wrongdoing at Barclays. Labour MP Simon Danczuk said: “Across the banks there are serious questions about who knew what and when and that must include the deputy chair of the Conservative Party. We have to get to the bottom of the Libor fixing scandal, and the Government must also agree to calls by Ed Miliband and Ed Balls for a proper independent inquiry into the culture of banking.” The questions over the role of Fallon followed the revelation that one of the Prime Minister’s closest advisers, the former Tory party treasurer Michael Spencer, is under scrutiny by the FSA. Mr Spencer’s brokerage firm ICAP is one of a number of institutions alleged to have helped to manipulate bank interest rates while he was treasurer of the Conservatives.

Mr Cameron said yesterday that he needed to “think this through carefully” whether there should be a judge-led inquiry into the Libor scandal. Fallon and Mr Spencer are not the only Tories with close links to the City, prompting concerns that the party is not enforcing tough action against the banking industry. Francis Maude, the Cabinet Office minister, was paid by Barclays to sit on its Asia-Pacific advisory committee between 2005 and 2009. A spokesman for Mr Maude said last night the minister was “absolutely not” aware of any wrongdoing at Barclays and that the committee met “three times over a couple of years”, was purely advisory and had no executive function. Fallon declined to comment.

Court documents filed in the US accuse Bank of England officials of failing to act on questions about “the integrity of Libor” raised during meetings of the Money Markets Liaison Group as early as 2007.The meeting was chaired by the BoE deputy governor, Paul Tucker, and attended by officials from institutions including at least seven that have since been named in Libor investigations.

The British Bankers Association assured group members of its “quality control measures”, and said that “they speak to contributing banks regularly.” The decision not to investigate further effectively enabled British bankers to go unchecked for more than a year. The FSA finally joined the investigation into Libor manipulation in October 2009, after other countries had already launched their own inquiries. A Bank spokesman said last night it was “nonsense” to suggest it had been aware of any Libor-fixing in 2007 or 2008.

The Conservative Party Connection

Michael Fallon: Deputy chairman of the Conservative Party, close ally of David Cameron and a reliable defender of the Government on the airwaves, the 60-year-old is a board member of Tullett Prebon Plc, a leading brokerage firm that dominates the rates market and which is being asked to co-operate with FSA inquiries. He resigned his directorship in the days after the coalition was formed, but was reappointed in September 2010. He receives a quarterly fee of almost £7,000 for 20 hours’ work.

George Osborne: In a statement to the Commons, the Chancellor of the Exchequer described the Libor scandal as a “shocking indictment of the culture at banks like Barclays in the run-up to the financial crisis”. But at the time that brokers were swilling Bollinger and fixing rates, Mr Osborne was trying to convince the City that he was not some callow newcomer but a chancellor in-waiting.In 2007, bruised by hostile briefings that he wasn’t up to the job, he made strenuous efforts to court the City, through the Conservative City Circle. This week he condemned his opposite number, Ed Balls, for failing to regulate the banks, but in 2007 he backed a Tory policy report written by John Redwood which called for deregulation of the mortgage market.

Michael Spencer: Spencer is a former treasurer of the Conservative Party. The 57-year-old, a close friend of David Cameron, is head of ICAP, a brokerage firm alleged to have helped manipulate bank interest rates while he was also Tory party treasurer from 2006 until October 2010. ICAP is being investigated by regulators over claims the Libor lending rates were rigged. He remains chairman of the Conservative Foundation, a body launched in 2009 for the party to receive legacies free of inheritance tax. He was among a list of party donors to have enjoyed “kitchen suppers” in the PM’s Downing Street flat.

Francis Maude: The Cabinet Office minister is a key Tory moderniser. He was a member of Barclays’ Asia-Pacific Advisory Committee for much of the boom from 2005. In an entry in the Register of Members’ Interests, he said: “My duties were to attend committee and other meetings by phone or in person; other advice and consultation by e-mail.” He received payment of £9,230.23 after tax for 15 hours’ work in 2009, and resigned at the end of that year. He joined the coalition government in May 2010.

2012: The Wheatley Report

David Cameron (acting on heavily publicised issues in the UK relating to the credibility of LIBOR) refused opposition proposals to appoint a Judge Led inquiry and instead commissioned Martin Wheatley, a managing director at the Financial Services Authority (FSA), to prepare a review of the way LIBOR was managed.

The outcome of that review (the Wheatley Review) was published in 2012. It proposed a ten point plan which was accepted. Key recommendations accepted: “https://www.gov.uk/government/uploads/system/uploads/attachment_data/file/191762/wheatley_review_libor_finalreport_280912.pdf”

Just about every major bank worldwide was caught in the net of price fixing scam of LIBOR. The cost to investors, home owners, mortgage holders was incalculable but exceeded many billions of dollars and brought about the Worlds financial crisis. Fines on banks are still being processed but exceed billions of dollars US.

In the UK only one LIBOR rate fixer ( middle management level) has been tried and convicted. The bankers got away with the biggest scam in history thanks to the Tory government.

2 Jul 2015: Financial Conduct Authority (FCA) – Osborne Strikes again

Having produced an excellent report it was no surprise when Martin Wheatley was asked to take on the leadership of the FCA charged with getting to grips with the banks, establishing order from chaos ensuring banking business in the UK met with the highest standards possible. He set about the task with purpose and quickly brought bankers to heel. But Martin had made enemies in the banking system and soon paid the price with his job. He was advised by Osborne that his 3 year contract would not be renewed. Having none of it Martin resigned his post.

In a parting statement Martin took a coded swipe at Osborne, saying that he had “unfinished business” and that the job of tidying up investment banking was far from complete. He went on to express disappointment that George Osborne had refused to renew his contract as chief executive of the Financial Conduct Authority,(FCA) despite the authority levying billions of pounds in fines and making top-level attempts to reform the culture of trading floors.

He also made it clear that the culture of investment banking remained largely unreformed despite several years of scandals. He said: “The top of organisations have understood the environment . . . but I still think it is quite hard to deliver. It’s tough and it takes time.

As we saw with FX [the foreign exchange-rigging scandal], there are some parts, the wholesale parts of financial services, where it is actually not yet seen as relevant. There’s still a view that: ‘Well, that’s a caveat emptor market’ and big financial players trading with one another. That’s the area that has much further to go.” Mr Wheatley’s damning appraisal of the City will pile further pressure on the FCA and Mr Osborne as the search gets under way to recruit a successor for the handover in September.

The chancellor will have the final say on any hiring decision but will want to avoid the perception that he has replaced a chief executive known for taking a hard line on wrongdoing with one more sympathetic to the big banks.

John Griffith-Jones, the chairman of the FCA, declined to say whether he had supported Osborne’s decision. “The appointment, or the question of renewal of Martin’s contract in March, is a decision for the chancellor. It is the job of the board, in particular the chairman, to run the organisation,” he said.

Wheatley left little doubt that if he had remained in charge of the FCA the banking industry would have faced no respite in his tough approach to regulation. He had considered banning some firms from trading as an alternative to fines, he said. “The use of trading bans, or, in our terms, ‘variations of permission’, is something we actively look at each time we feel that we’ve got to take an action. Those variations of permission can be removing somebody from part of the market, or a significant part of the market, for a period of time,” he said.

Wheatley’s remarks came after the FCA’s annual meeting, where members of the public questioned senior executives on the regulator’s actions. At a fiery session in central London, Mr Wheatley and his team faced repeated criticism for their handling of the compensation process for victims of the mis-selling of interest rate hedging products.

Wheatley defended the FCA-led redress scheme, pointing out that nearly £2 billion had been paid back to small and medium-sized businesses. Several small businessmen argued that no bank had been fined despite overwhelming evidence of the systematic mis-selling of tens of billions of pounds of interest rate swaps to customers who did not understand what they were buying.

Wheatley later said that banks could still face action from the regulator for their behaviour. “We haven’t ruled out that there will be actions taken at some point,” he said. It was this statement that brought about his downfall. There would be no further pursuit of Bankers so long as the Tories were in power at Westminster.

6 January 2016: It is shamefully clear now that Osborne has let the banks off the hook

The banks are no longer in the doghouse – or, at least, not so far as the government is concerned. Never mind that their manipulation of financial markets against the interests of their customers is still fresh in the mind and that the courts are handing down prison sentences for those found guilty. Forget all that stuff about high-street banks mis-selling financial products to their customers, you and me in other words, for which they have had to set aside a colossal £26bn to meet claims. It is, apparently, time to move on. Of course, there has been no announcement as such. This is a case where you look at the facts and draw your conclusions. For me, the final proof came with this week’s announcement by one of the City’s two regulators, the Financial Conduct Authority (FCA), that it was abandoning its plan to inquire into the culture of banks.

Compare this withdrawal with what this same regulator said less than a year ago about the importance of culture: “Our Risk Outlook 2014/15 noted how important embedding cultural change would be to regaining the trust of consumers, as well as achieving our objectives. This remains true for the coming year and the foreseeable future… We continue to address conduct issues arising from failures in firm culture and are committed to ensuring this momentum is not lost.” Now this commitment has gone. How did this come about? The most plausible starting point is April 2015. With just a few weeks to go before the General Election, the giant bank HSBC announced that it had ordered a review into whether it should move its headquarters out of Britain, thus damaging London’s reputation as a global hub for finance and investment.

The Chancellor of the Exchequer, George Osborne, cannot have liked the sound of this. Threatening to move domicile is frequently used by large international companies as a way of bringing pressure to bear on national governments. Just seven weeks later in a Mansion House speech in June, Mr Osborne made plain his discomfort. He said he wanted Britain to be “the best place for European and global bank HQs”, adding: “It’s in our national interest to be so.” At the same time, the door to the doghouse was to be left open: “Our financial services industry in Britain has, in recent years, been seen as part of the problem – now it must become part of the solution… Now we can raise our ambition and ensure we have the best, and most competitive, financial services in the world”.

Except that the Chancellor himself doesn’t have the key in his own pocket. It is the FCA which opens or closes the door. And under its tough chief executive, Martin Wheatley, the prospect of the lock being turned seemed remote. So Mr Wheatley would have to go. Thus seven weeks later, 17 July, Mr Wheatley was sacked. Osborne said “different leadership” was needed to take the regulator forwards. “Britain needs a tough, strong financial conduct regulator.

The government believes that different leadership is required to build on those foundations and take the organisation to the next stage of its development,” he said. In proceeding thus, the Chancellor had had a stroke of luck. For under Mr Wheatley’s leadership, the FCA had committed a serious error some months earlier. It had deliberately leaked a story to the Daily Telegraph stating that the regulator was planning an inquiry into 30 million pensions and savings policies sold from the 1970s to 2000 with a focus on high fees and bad service.

Within seconds of the stock markets opening, shares in insurance companies crashed as shareholders took fright at the likely damage to their investments. The regulator took 15 hours to respond, in a reaction deemed “seriously inadequate” in an independent report. Osborne immediately declared himself “profoundly concerned” and described the events as “damaging both to the FCA as an institution and to the UK’s reputation for regulatory stability and competence”. From then onwards Mr Wheatley was at the mercy of the Chancellor.

Meanwhile, Osborne had opened another door to bankers – the door to his own office. Since the 2015 General Election, he has privately met with representatives of the banks five times. This compares with no meetings in the same period of 2014. And as the bank chiefs walked into his office, they will have known that they had a lot going for them despite their poor treatment of customers and brushes with the law. They would be speaking to a Chancellor who, reassuringly, believes in deregulation, who is comfortable with a minimum state and who wants to keep down levels of income tax.

They would know, too, that the government couldn’t be complacent about the City’s future. For there are constant threats from Brussels as well as competition from financial centres in the East.

So here I try to put myself into the bankers’ shoes and I imagine they say to Osborne something like this: “Look, we both really want the same thing. You want to keep the City as the world’s pre-eminent financial centre. And we want to feel comfortable doing business here. That means, to be frank, lighter regulation and lower taxes. So we can do a deal, surely?’

The Chancellor seems to have listened and the FCA seems to have caught the drift. So at the same time that it called off its inquiry into bank culture, it also announced that it would be taking no formal action against HSBC following indications that the bank’s Swiss unit had been giving customers a helping hand with their tax liabilities. So the door to the doghouse swings on its hinges. The bankers are no longer there and will not be returning any time soon.

Leave a comment